I wrote sometimes early this year to support government’s long term concessionary loans to finance infrastructure in the 2019 budget. Nigeria needs to copy America under its President, Franklin D. Roosevelt who built the big stuff, an infrastructural project that set America on path of unprecedented growth. Nigeria can be ahead of its contemporaries in Africa if it can build the big stuff.

Without doubt, Roosevelt built America. United States is great because of its infrastructure. Using combinations of public and private money, Roosevelt hired millions of American workers and eventually built 78,000 bridges, 650,000 miles of roads, 700 miles of airport runways, 13,000 playgrounds and 125,000 military and civilian buildings, including more than 40,000 schools, in most cases of very high standards and quality.

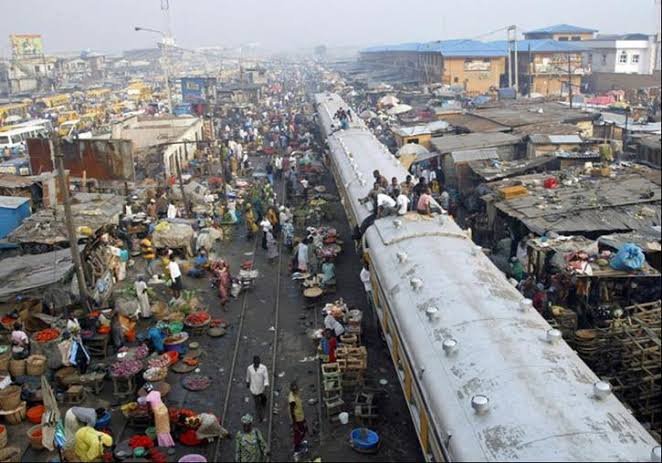

This is one of the reasons l supported government plan to borrow because the money was meant to be spent on infrastructure, especially roads, power plant and railways, some of the major pillars of development.

Federal government can do extremely well to heal the nation by building infrastructure everywhere.

As for borrowing, Nigeria with its current level of debt at $81.7bn according to latest CBN figures, against a GDP of $528bn, is among the least indebted nation of its size in the world. Nations that fear borrowing are nations that lack confidence in their fiscal and monetary discipline, where transparency and accountability are in short supply.

Like l said earlier, l would never support borrowing under the previous government of Goodluck Jonathan because of its profligate spending, recklessness and large scale corruption. But this government is a government of prudence and accountability.

You can argue and quote financial scandals here and there, but the truth is no government can match PDP is terms of stealing. This government will not borrow money to waste on campaign or steal under bogus contracts. If there is one thing l continue to believe in Buhari, it is the trust l have on him with Nigeria’s wealth, and his determination to root out corruption in the country.

Infrastructure is what makes nations great. Dubai was founded some thirty years ago. Today it is the most visited city on earth, upstaging London, because of its infrastructural development.

See also: How Children Are Kidnapped, Renamed and Sold

Let Nigeria do the same by building infrastructure to become the aviation and maritime hub of Africa, and many more.

Nigeria is not among the 20 most indebted nations in the world, by GDP ratio. Debt is a function and a fixture of any working economy. Governments borrow to fund spending on things like roads, hospitals, and schools, as well as to fund promises like tax cuts.

Debt-to-GDP ratios around the world have increased in recent years as governments take advantage of historically low interest rates to pile up cheap debt before rates inevitably begin to rise.

Borrowing is a good thing for a working economy, but unchecked borrowing can be a bad thing, especially in an economic downturn. Even cheap debt can become unaffordable if a country has too much of it and output begins to slow.

The level of gross government debt as a percentage of GDP can indicate how able a country is to pay back debts without incurring further debt. Basically the lower the debt-to-GDP ratio the better.

The CIA’s annual World Factbook, a huge and pretty comprehensive compilation of data and statistics from all over the world, includes figures on nations’ debt-to-GDP ratios from around the world.

Numbers are given as a percentage of GDP, so if a country has a GDP of £100 billion and a gross debt of £110 billion, it has a debt-to-GDP ratio of 110%. No hope for infrastructure.

Here are the 23 nations with the highest debt-to-GDP ratio:

- Brazil — 89.4%: In the midst of a crippling recession and facing down several huge political corruption scandals, Brazil has seen its debt-to-GDP ratio jump higher in recent years.

- Sao Tome and Principe — 89.5%: The island nation, which has less than 200,000 citizens and a GDP of $350 million, is at “high risk of debt distress” according to IMF, and must implement austerity measures to combat this.

- Jordan — 90.6%: A 2016 World Economic Forum report said that “addressing macroeconomic challenges will be key to freeing up public funding for competitiveness-enhancing investment” in Jordan. Trade and investment suffer thanks to Jordan’s proximity to nations like Iraq and Syria.

- United Kingdom — 92.2%: The UK’s government debt is a political football used by opposition parties to attack the government’s economic record. Debt has increased significantly in recent years, although the deficit has reduced after 7 years of austerity.

- Yemen — 92.2%: Alongside its huge debt burden, Yemen is in the midst of a humanitarian crisis, with what the UN calls “the world’s worst cholera outbreak” sweeping through the country, impacting some 200,000 people. It is also engaged in conflict with neighbouring Saudi Arabia.

- Egypt — 92.6%: Egypt’s debt has started to moderate after increasing rapidly in the years after the financial crisis and during the Arab Spring.

- France — 96.5%: France’s government debt to GDP ratio has widened this year as it struggles with weak productivity and wages.

- Canada — 98.8%: Canada is significantly more indebted on a debt-to-GDP basis than its southern neighbour, the United States of America.

- Spain — 99.6%: A victim of the eurozone debt crisis, Spain’s economy is battling chronically high unemployment — particularly among the country’s youth.

- Mozambique — 100.3%: Mozambique has hit headlines in recent weeks after it emerged than around $500 million of a $2 billion loan given to the country was unaccounted for.

- Cyprus — 104.6%: Highly exposed to Greece during the eurozone debt crisis, it is unsurprising that Cyprus has a huge debt burden. Things have been made worse by the downgrading of its credit rating to “junk” status, making it more expensive to borrow.

- Belgium — 106.7%: The country is home some of the most powerful people in the world, with key EU headquarters in Brussels, but the nation suffers from high government debt levels as it battles with restrictive labour and tax regulations.

- Barbados — 108.9%: The tax-haven nation is the wealthiest and most developed country in the eastern Caribbean, but its growth prospects look weak after the introduction of austerity measures to combat the effects of the credit crisis.

- Grenada — 110%: The Caribbean island nation has built an unsustainable debt pile in recent years, and has been forced to default on repayments several times as a result.

- Singapore — 110.5%: In an attempt to tackle its chronically high debts, the government is now trying to find new ways to grow the economy and raise productivity.

- Cape Verde — 116.8%: The tiny Portuguese-speaking island nation in the Atlantic has seen its debt burden grow rapidly in recent years, with the debt-to-GDP ratio jumping from 70% in 2010.

- Eritrea — 119.8%: The tiny African nation is one of the world’s least developed nations, and has a GDP of just over $2.6 billion. “Eritrea has suffered from chronic fiscal deficits since regional insecurity heightened in 1998,” the World Bank notes, adding that this “has led to a highly unsustainable public debt burden.”

- Portugal — 126.2%: Portugal exited its own bailout programme in the middle of 2014, but it is still trying to recover from the impacts of the eurozone debt crisis.

- Jamaica — 130.1%: The Caribbean island is one of the world’s most indebted countries after decades of heavy borrowing. It has frequently received loans from the IMF to help it make repayments on debts, which has perpetuated its problems.

- Italy — 132.5%: Italy is the eurozone’s second most indebted country, and probably the single currency bloc’s biggest economic risk. The country’s financial system is in turmoil, with two banks bailed in this week. If the system were to blow up, things would be much worse than what we saw in Greece.

- Lebanon — 132.5%: “Lebanon emerges as a prime suspect for facing a debt crisis based on its weak solvency metrics. Standard debt-sustainability models, derived rules of thumb and other countries’ experience suggest that these are early signs of a debt crisis,” Carla Slim, an economist at Standard Chartered told the FT earlier in June.

- Greece — 181.6%: The country is continuing to suffer since the sovereign debt crisis of 2010. It is still struggling to make debt repayments after being bailed out continually by international creditors and is still in full force of a stringent austerity drive.

- Japan — 234.7%: Easily the highest ratio of debt-to-GDP goes to Japan, which has seen its economy face a rapidly aging population and glacially slow rates of growth thanks to weak productivity in recent years.

By Aliyu Nuhu