From being penned as a disruptor in the finance and investment industry to taking mugshots in Lagos state Police command for fraud, in this piece, we go through the unfortunate cliche grace to grass story of the 21-year-old Dominic Joshua.

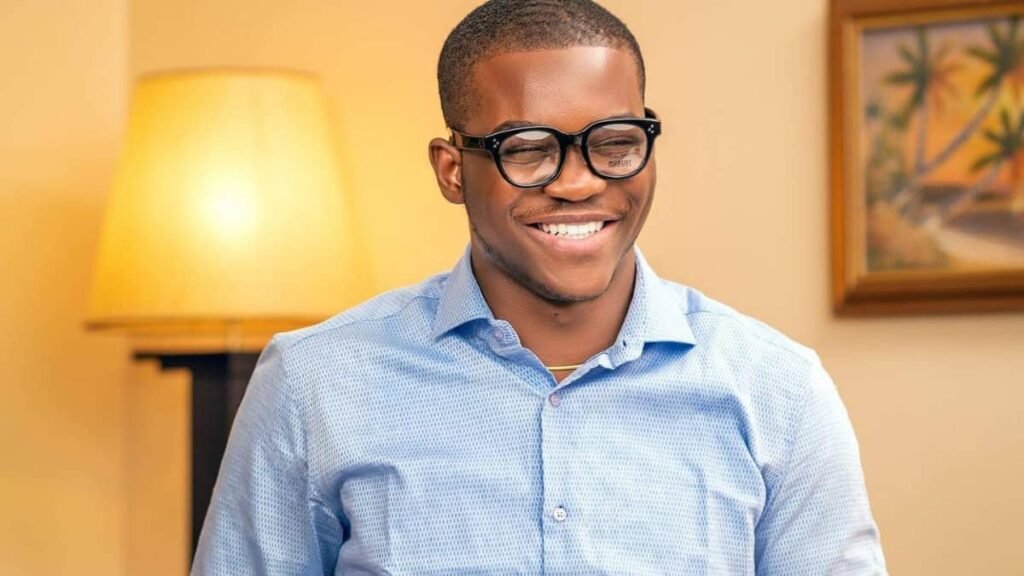

The Ebonyi born investment guru has established himself as a stronghold in the industry with his business inventions and directions on empowerment. For years, Dominic has navigated the business world from oil and gas to agriculture to building technology and most recently forex and other forms of cryptocurrency trading, priding himself as a visionary investment expect who is keen on providing empowerment for the masses.

After the heat of the Ponzi scheme epidemic that ravaged Nigerians in 2016/2017, causing an economic depression, Joshua set out to initiate an investment venture, Brisk Capital, to alleviate poverty and put the people out of their misery in 2018 or so we thought. This venture, however, was kept under wraps and reserved for the select few that were opportune to know about it.

Disruptor to Detention: Dominic Joshua Ngene

Coming to the rescue again and further pursuing his life goal of empowering people to financial freedom, Dominic came to the people’s aid by making his investment platform open to the public in August 2020. This was just when Nigeria reached its worst inflation rate of 14.23%. To top it off, this early-stage business promised its investors 60% ROI.

Owing to these efforts, a popular business media outfit, BusinessDay in a now-deleted article, hailed him as a ‘Disruptor in the Investment Banking Industry’.

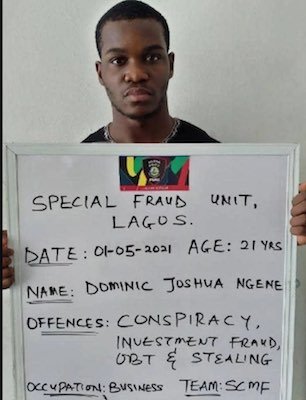

One year after going public and the story takes an interesting twist as the Chief Executive officer of Brisk Capital is captured in mugshot by the Lagos state Special fraud Unit for conspiracy, investment fraud and stealing and of course, his investment platform, Brisk Capital that has its reins in fashion, finance and agriculture among others as the cover.

He was accused of diverting funds of unsuspecting Investors calculated to be about N2 billion through fake investments in cryptocurrency, real estate, forex, oil and gas. Reports had it he defrauded over 500 investors with a promise of a 60% return on investment, a tempting offer for ravenous business people.

Dominic ‘invested’ these funds in exotic parties, real estate and luxurious lifestyle and in return, the investors got parched accounts with trappings of radio silence.

Although the commissioner of the Special Fraud Unit, Anderson Bankole, stated that Dominic Joshua confessed to the crime and advised people to refrain from investments with unbelievably high returns, will it really stop?

Despite seeing all that happened with MMM, some Nigerians are more than willing to take a nosedive into a refurbished Ponzi scheme dressed in a suit and tie.