Over tax collection, the Abuja Municipal Area Council, AMAC, has said it is fighting against corrupt individuals hiding under its cover to extort money from businesses and residents in the Federal Capital Territory, FCT.

The Chief Revenue Officer of AMAC, Hon. Danlami Awaje disclosed this while responding to allegations first published by the International Center for Investigative Reporting, ICIR, that the activities of some of the council officials are having negative impacts on businesses in Abuja.

He spoke on Public Conscience on Radio, the anti-corruption radio program produced by the Progressive Impact Organisation for Community Development, PRIMORG, recently in Abuja.

Awaje, who alluded that the tales of taxation fraud in AMAC have been a recurring issue, revealed that AMAC has set up a task force team moving round to fish out individuals posing as AMAC officials to defraud the unsuspecting Abuja business owners and residents through taxes and levies.

His words: “AMAC has set up a task force that is moving around, checking and looking out for individuals who are not AMAC staff but are extorting and collecting revenue from business owners and residents.

“Meanwhile, following an outcry from the public, the council also disbanded a group set up to bring sanity on the roads but were now harassing and extorting money from car owners on the road.”

Awaje warned that AMAC does not give out personal bank account numbers when collecting taxes but uses the government-approved platform ‘REMITA’ in order to promote accountability.

He stressed that: “AMAC’s revenue officers who go out to collect revenues undergo training and retraining from time to time, we have REMITA platform where we ask all our taxpayers to pay into, generate RRR, pay through REMITA, come with the evidence of payment and obtain official receipt from our office.”

He revealed that the constitution mandates AMAC to collect no fewer than 21 different taxes from business owners in Abuja annually while urging taxpayers in Abuja to be conscious of who approaches them to collect taxes.

On her part, an Abuja-based food vendor identified as Chef Nneka, whose business has been affected by the arbitrary taxes, decried the lack of impact in the form of infrastructure despite the numerous taxes collected by the AMAC administration.

“I pay my taxes in January because if you don’t pay, they will keep harassing you until you pay, but they (AMAC) are not doing anything for us.

“In a year, I pay for bikes, health, environment, business premises, outdoor signage, radio, and television licenses, and it goes on and on. And just yesterday, I was served another paper to pay three hundred thousand Naira for gas emission,” She lamented.

Earlier, senior lecturer of Law, Base University, Dr Sam Amadi explained that people living in the Federal Capital Territory, FCT, risk paying multiple taxes because most of the taxes for federal workers also apply for people working under FCT.

Dr Sam Amadi cautioned that FCT would have problems navigating between federal taxation and that of the councils.

“Now think in terms of Julius Berger you will be shocked that maybe it might not be paying anything to the area council but might be paying directly to the federal government, and because there is no capacity to compel them, the council will leave them and go to the small or micro-enterprises and overtax them”, He said.

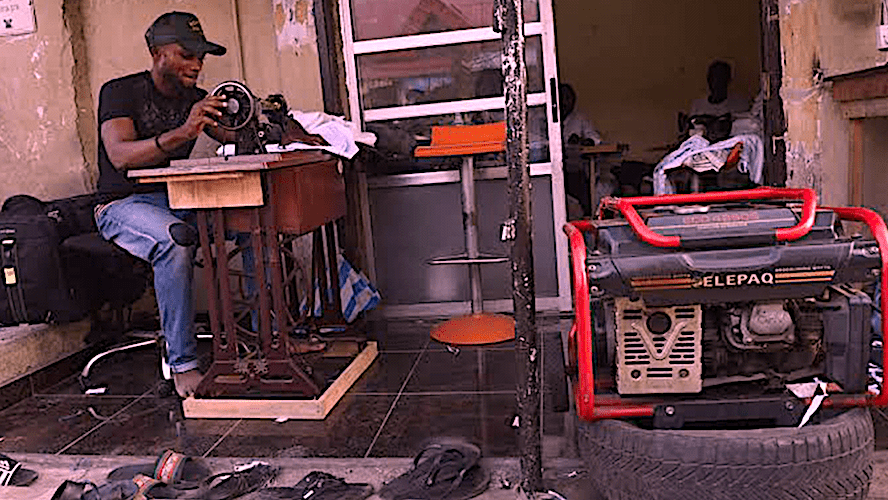

Tax Collection: Businesses to Pay Fees for Using Generator

Last week, everyevery.ng reported that the Federal Capital Territory Administration, FCTA, informed banks, industries and warehouses operators that, henceforth, the authorities would commence collection of annual taxes.

The notice signed by Ahmed Haruna, the Director of Public Health, AMAC, reads, “Management of Abuja Municipal Area Council Environment Services, ESD Bodies, wishes to notify you of levy/fees due to Abuja Municipal Area of Council for Gaseous Emission Permit.

“This includes (the) discharge of harmful hazardous substance(s) into the air or the land and the water in Nigeria by the activities of industries, warehouse(s), bank(s), either from generator(s) or heavy-duty drilling, production, construction and manufacturing equipment, filling stations, etc.”

According to AMAC, the levy is in line with the provision of section (2C) of the fourth schedule to the Nigerian Constitution “as amended under the function of the Local Government Authority and Federal Environmental Protection Agency Act, FEPA, Section 25.”

The law mandates the council “to regulate, enforce, and collect levies for the interest of public health importance.”

“Also note that failure to comply with this foregoing regulation is (a) punishable offence,” the notice warned, “and we will seize the activities of the organisation and arrest as prescribe in part iv section 27 subsection 1 ABCD and (2) of FEPA ACT 1992.”